On October 29th, 2014 in Berlin, Germany, the Cayman Islands and 50 other jurisdictions signed on to the OECD Multilateral Competent Authority Agreement (“MCAA”) for the implementation of the automatic exchange of tax information, based on the OECD’s Multilateral Convention on Mutual Administrative Assistance in Tax Matters (“Multilateral Convention”).

The MCAA requires the Competent (Tax) Authorities of participating jurisdictions to collect and automatically exchange tax information prescribed by the OECD’s Common Reporting Standard (“CRS”). The MCAA is similar in form and substance to the U.S. and U.K. intergovernmental agreements (“IGAs”).

Cayman Islands Reporting Financial Institutions (“RFIs”) such as hedge funds, private equity funds, and securitization special purpose vehicles, will now have substantially expanded international tax compliance obligations starting in 2016. They will have broader and more detailed FATCA reporting obligations pursuant to the U.S.-Cayman IGA, new reporting obligations pursuant to the Cayman-U.K. IGA, and new due diligence obligations under “GATCA” – i.e. Global FATCA promulgated by the G20 and OECD.

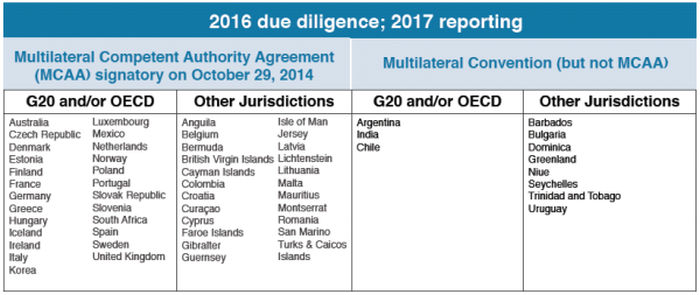

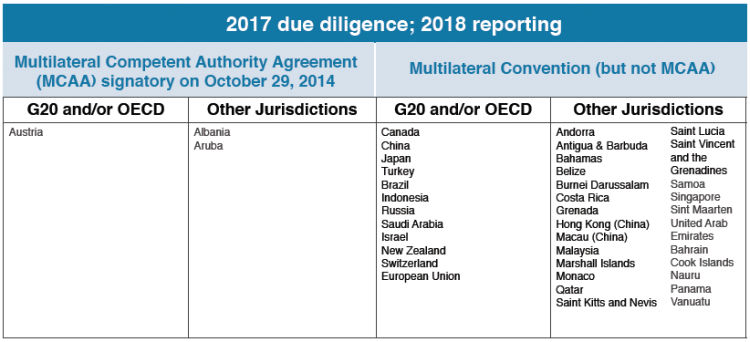

The OECD website will publish the status of all Competent Authorities compliance with the various MCAA requirements. The following table indicates those jurisdictions which have signed on to the MCAA and the other jurisdictions which have committed to automatic exchange of tax information pursuant to the Multilateral Convention.

The MCAA will be activated when each Competent Authority provides the OECD with confirmation that they have the necessary legislation in place to implement the CRS and have specified the relevant effective dates with respect to Preexisting Accounts, New Accounts, and the application or completion of the reporting and due diligence procedures. The Cayman Islands has already implemented The Tax Information Authority (Amendment) (No.2) Law, 2014 on June 26th 2014 together with various International Tax Compliance Regulations on July 3rd 2014 to enable the automatic exchange of information for tax purposes with other Competent Authorities.

In summary, the TIA and the other Competent Authority must each:

- Specify the methods for data transmission including encryption, any safeguards for the protection of personal data and confirm that it has in place adequate measures to ensure the required confidentiality and data safeguards standards are met.

- Provide a list of the Jurisdictions of the Competent Authorities with respect to which it intends to have the MCAA in effect, following national legislative procedures (if any).

Steps to Compliance

RFIs, their service providers and professional advisors should closely monitor the OECD and TIA websites and announcements regarding these new international tax compliance obligations to ensure the necessary legal and operational changes are made timely.

1. http://www.oecd.org/tax/exchange-of-tax-information/

2. http://www.tia.gov.ky/html/assistance.htm

Financial institutions’ due diligence obligations under FATCA and the U.S. IGAs commenced on July 1, 2014 and their first reporting is due in 2015. According to the OECD, the U.S. will honor its automatic exchange of information obligations under reciprocal IGAs in 2015. The U.K. IGA due diligence obligations of financial institutions resident in U.K. Crown Dependencies and Overseas Territories also commenced on July 1, 2014 and their first reporting is due in 2016. The following timetable distinguishes which jurisdictions have commitments under the MCAA or the Multilateral Convention.

About DMS

DMS Offshore Investment Services Ltd. (DMS) is the worldwide leader in fund governance with more than 225 professionals representing leading investment funds with assets under management exceeding $330 billion. DMS provides trusted and comprehensive Fund Governance, FATCA, AIFMD, Banking + Custody, Trust, Corporate and Outsourcing solutions that support investments across a range of structures, and diverse investment strategies.