The Cayman Islands today took a significant step against global tax evasion in joining more than 50 countries and jurisdictions in signing an agreement that sets the worldwide standard for automatic exchange of information (AEOI) among tax authorities.

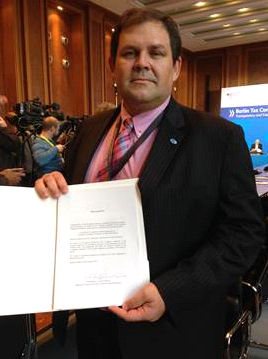

The Multilateral Competent Authority Agreement (MCAA) was developed by the OECD, in cooperation with G20 countries. Minister of Financial Services, Commerce and Environment, Wayne Panton, signed the Cayman Islands’ formal Declaration on Joining the MCAA.

‘Although Cayman is one of the more than 50 early adopters that have committed to begin AEOI exchanges in 2017, our history of cooperation reaches back to 2005, when we began participating in EUSD’, he said.

‘Furthermore in April 2013, based on our understanding of the direction of global efforts, we informed the UK that we would join what was known then as the G5 pilot – an initiative announced by the UK, France, Germany, Italy and Spain, regarding the multilateral automatic exchange of tax information’. More than 90 countries now have committed to implementing the new global standard of AEOI.

Minister Panton noted that US also has indicated that it will undertake AEOI pursuant to FATCA from 2015, and that it has entered into intergovernmental agreements (IGAs) with jurisdictions, including Cayman, to do so.

‘For Cayman to sign the MCAA is a logical progression in our longstanding international cooperation efforts, and we are pleased that so many countries and jurisdictions are now part of this worldwide effort to fight tax evasion via a global standard, across borders’, he said.

Accompanying Minister Panton were the Ministry’s Chief Officer, Dr Dax Basdeo, and Director of the Department for International Tax Cooperation, Duncan Nicol. The signing was held after the 7th meeting of the Global Forum on Transparency and Exchange of Information for Tax Purposes, in Berlin.

The Global Forum’s website states that it is the world’s largest network for international cooperation in the field of taxation and financial information exchange, bringing together 122 countries and jurisdictions as well as the European Union.

The Berlin meeting drew more than 300 delegates, from 101 member jurisdictions and 12 international organisations, to discuss ways to accelerate international cooperation against tax evasion. This included planned improvements to the standard on exchange of information on request, including introduction of a requirement that information be available on beneficial owners of legal entities.

Minister of Financial Services, Commerce and Environment, Wayne Panton, signs the Cayman Islands’ formal Declaration on Joining the Multilateral Competent Authority Agreement. The signing was held today in Berlin.