On March 26, 2015, Quebec’s minister of finance, Mr. Carlos J. Leitão, tabled his government’s second budget (Budget 2015-2016), which contains several tax measures for businesses.

This bulletin summarizes the key measures included in the Budget. Note that the measures contained in the Budget do not have force of law and will have to be passed by the National Assembly.

Follow-up to the recommendations of the Quebec Taxation Review Committee

In Budget 2015-2016, the government introduces several measures based on the recommendations of the Quebec Taxation Review Committee (the Committee) announced on March 19, 2015, including:

- gradually reducing the contribution rate to the Health Services Fund (HSF) for small and medium-sized businesses (SMBs) in the service sector from 2.7% to 2.25%;

- reducing the tax rate for SMBs in the primary sector from 8% to 4%;

- refocusing the small business deduction (SBD) on job-creating SMBs;

- gradually reducing the general corporate income tax rate from 11.9% to 11.5%;

- reducing the rate of the tax credit on manufacturing and processing equipment;

- reviewing tax credits aimed at the new economy; and

- expanding certain tax credits for Quebec’s cultural sector.

However, the government did not accept the Committee’s recommendation to make all tax credits non-refundable, particularly for large businesses.

Finally, Budget 2015-2016 provides for the creation of a working committee to analyze the Committee’s recommendations in detail and start discussions with the federal government, particularly regarding the taxation of capital gains, the preferential treatment granted to stock options, the fight against tax evasion, tax avoidance and aggressive tax planning schemes and the use of trusts to shift the tax base outside Quebec.

Measures for businesses

Reducing the corporate income tax rate

Reducing the general corporate income tax rate

Budget 2015-2016 provides for a gradual reduction in the general corporate tax rate from 11.9% to 11.8% as of January 1, 2017, 11.7% as of January 1, 2018, 11.6% as of January 1, 2019 and 11.5% as of January 1, 2020.

Where a corporation’s taxation year does not coincide with the calendar year, the effective tax rate will be adjusted to reflect the number of days of the taxation year that are included in each calendar year.

The rate applicable to corporations eligible for the SBD does not benefit from a consequential amendment and the rate will therefore be maintained at 8%.

Refocusing the SBD for corporations the primary and manufacturing sectors

To refocus the SBD on certain types of corporations, eligibility criteria will be added, Specifically, for a taxation year, a corporation, in order to claim the SBD, will be required to be:

- a corporation that (i) employs throughout the year more than three full-time employees, or (ii) if any other corporation associated with it provides financial, administrative, maintenance, managerial or other similar services to it, could reasonably be expected to require more than three full-time employees if those services had not been provided by the other corporation; or

- a corporation in the primary or manufacturing sector.

For the purposes of this measure, “corporation in the primary or manufacturing sector” will mean a corporation at least 25% of whose labour cost is attributable to activities consisting of activities that are in the primary sector or the manufacturing and processing sector.

The SBD rate available to a corporation in the primary or manufacturing sector will therefore depend on the proportion of activities in the primary sector or the manufacturing and processing sector. Activities in the primary sector are those attributable to activities in the agriculture, forestry, fishing and hunting sector and the mining, quarrying, and oil and gas extraction sector. Manufacturing and processing activities are those that, under the already existing criteria, constitute qualified activities for the purposes of determining manufacturing and processing profits.

The amendments to refocus the SBD on corporations in the primary or manufacturing sector will apply to a taxation year beginning after December 31, 2016.

Extension of the additional deduction for manufacturing SMBs to SMBs in the primary and manufacturing sectors

Currently, a manufacturing SMB eligible for the SBD may obtain an additional reduction of its tax rate, which will reach 4% as of April 1, 2015.

Changes will be made to the additional deduction for manufacturing SMBs to extend eligibility for the additional deduction to corporations in the primary sector and modify the calculation parameters. The additional deduction rate applicable to a corporation in the primary or manufacturing sector will therefore depend on the proportion of its activities that are in the primary sector or the manufacturing and processing sector.

The amendments to extend the additional deduction for manufacturing SMBs to SMBs in the primary sector and the amendments to modify the calculation parameters will apply to a taxation year beginning after December 31, 2016.

Gradual reduction of the Health Services Fund (HSF) contribution rate for SMBs in the service and construction sectors

An employer must pay a contribution to the HSF in respect of the wages that it pays to an employee who reports for work at the employer’s establishment in Quebec or, if the employee is not required to report for work at an establishment of his or her employer, that it pays from an establishment in Quebec.

Currently, the contribution payable to the HSF is calculated at a rate of 4.26%, unless the employer is a specified employer for the year and the employer’s total payroll is less than $5 million.

The applicable rate for the purposes of calculating the contribution to the HSF payable by a specified employer, other than an eligible specified employer, is 2.7% if the employer’s total payroll for the year is $1 million or less. That rate rises linearly to 4.26% for specified employers whose total payroll is between $1 million and $5 million. The rate for eligible specified employers ranges from 1.6% to 4.26%.

To ease the tax burden on SMBs in the service and construction sectors, the rate of the contribution to the HSF for employers in these sectors whose total payroll is equal to or less than $1 million will gradually decrease from 2.7% to 2.25% over a three-year period beginning in 2017. Employers whose total payroll is between $1 million and $5 million will also see a gradual reduction in their contribution rate.

Changes to the tax credit for investments relating to manufacturing and processing equipment

Briefly, a qualified corporation that acquires qualified property may claim the tax credit for investments relating to manufacturing and processing equipment in respect of eligible expenses it incurred, in excess of $12, 500, to acquire the property.

Reduction of the tax credit rates

The base rate for the tax credit is 4%. That rate may be increased up to as much as 32% if certain conditions are met. The tax legislation will be amended to reduce by eight percentage points the rate of the tax credit applicable to qualified property acquired to be used mainly in a remote zone (i.e. from 34% to 24%), the eastern part of the Bas-Saint-Laurent administrative region (i.e. from 24% to 16%) or an intermediate zone (i.e. from 16% to 8%).

Lastly, given that the reduction in tax assistance with respect to the tax credit is eight percentage points and the tax credit in respect of eligible expenses incurred to acquire property other than property acquired to be used mainly in a remote zone, in the eastern part of the Bas-Saint-Laurent administrative region, or in an intermediate zone may not exceed 8%, the tax legislation will be amended so that such expenses no longer give entitlement to the tax credit.

These amendments will apply in respect of eligible expenses incurred after December 31, 2016.

Extension of the tax credit and changes to the definition of qualified property

The definition of qualified property will be amended so that an additional period of five years is allowed for the acquisition of such property for the tax credit.

This definition will also be changed so that only property acquired after December 31, 2016, to be used mainly in a remote zone, the eastern part of the Bas-Saint-Laurent administrative region or an intermediate zone may qualify.

Increase in the refundable tax credit for on-the-job training periods

An eligible taxpayer may, under certain conditions, claim a refundable tax credit for on-the-job training periods where a student serves a qualified training period with a business carried on in Quebec by the taxpayer or by a partnership of which the taxpayer is a member.

The tax legislation will be amended so that the base rates for the tax credit are raised to 40% for a corporation and 20% for an individual, respectively, and the increased rates applicable to an eligible trainee, who is a disabled person or an immigrant, are raised from 50% for a corporation and 25% for an individual, respectively.

These amendments will apply in respect of a qualified expenditure incurred after the day of the Budget Speech in relation to an eligible training period beginning after that day.

Changes respecting the refundable tax credit for the integration of information technology in manufacturing SMBs

In October 2013, a new refundable tax credit was temporarily introduced to support Quebec’s manufacturing SMBs in respect of expenditures relating to the supply of a qualified management software package that they incur before January 1, 2018.

The tax credit is equal to 25% of expenditures relating to a qualified information technology (IT) integration contract for which Investissement Québec has issued a certificate. The total amount of the tax credit was limited to $62,500. After Budget Speech 2014-2015, Investissement Québec could no longer issue such certificates and taxpayers therefore could not claim the tax credit.

In Budget 2015-2016, the government announced that it will allow certificates to be issued again for the purposes of this tax credit, extend the duration of the tax credit for two years, reduce the rate of the tax credit and, lastly, extend the tax credit to corporations in the primary sector.

Phasing out of restrictions on the granting to large businesses of the input tax refund

Under the Quebec sales tax (QST) system, large businesses cannot claim an input tax refund (ITR) in respect of certain property and services acquired in the course of their commercial activities:

- road vehicles of less than 3,000 kg that must be registered under the Highway Safety Code to be driven on public highway and gasoline used to power the engine of such road vehicles;

- electricity, gas, combustibles and steam used for a purpose other than to produce movable property intended for sale;

- most telecommunications services;

- food, beverages and entertainment whose deductibility is limited under the Taxation Act (Quebec).

As part of QST/GST harmonization, the Quebec government undertook to phase out these restrictions on ITRs for large businesses in equal annual proportions over a three-year period beginning no later than January 1, 2018.

To follow through on that undertaking, the QST system will therefore be changed to allow large businesses to claim an ITR in respect of property and services to which the restrictions currently apply, at the rate of 25% in 2018, 50% in 2019, 75% in 2020 and, ultimately, 100% as of 2021.

These amendments will apply to QST that becomes payable as of January 1 of each year in question.

Harmonization of provincial legislation with measures announced by the Department of Finance Canada

In Budget 2015-2016, the government announced that it expects to enact the amendments that need to be made to the Mining Tax Act in order to incorporate the measures announced by the federal minister of finance to support mining exploration and temporarily increase capital cost allowance rates for assets used in natural gas liquefaction.

Revison of tax assistance for businesses

Refundable tax credits for the production of multimedia titles

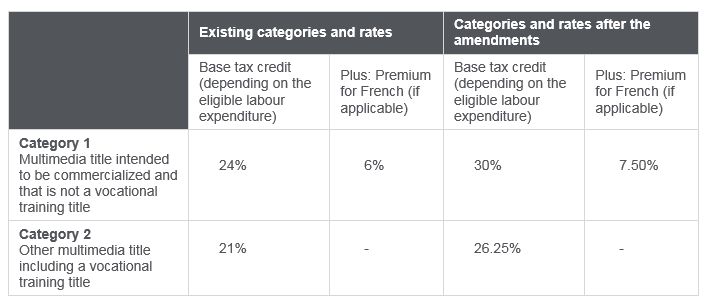

Under Budget 2014-2015, the refundable tax credit relating to the production of multimedia titles and the refundable tax credit applying specifically to corporations whose activities consist chiefly in producing multimedia titles were each reduced by 20%.

The tax legislation will be amended to increase the tax credit rates as follows:

The tax legislation will be amended to provide that the qualified labour expenditure in respect of an eligible employee may not exceed $100,000, calculated on an annual basis.

Refundable tax credit for the development of e-business (TCEB)

The TCEB provides tax assistance for specialized businesses that carry out innovative, high value-added activities in the IT sector. This 24% credit is granted to a qualified corporation that pays salaries to eligible employees carrying out an eligible activity in that sector. The tax legislation will be amended to eliminate the end date of this credit, which was set at December 31, 2025.

In addition, a new, 6% non-refundable tax credit will be introduced. All the conditions that apply to the refundable TCEB will apply to the new credit. These amendments will apply after the day of the Budget Speech.

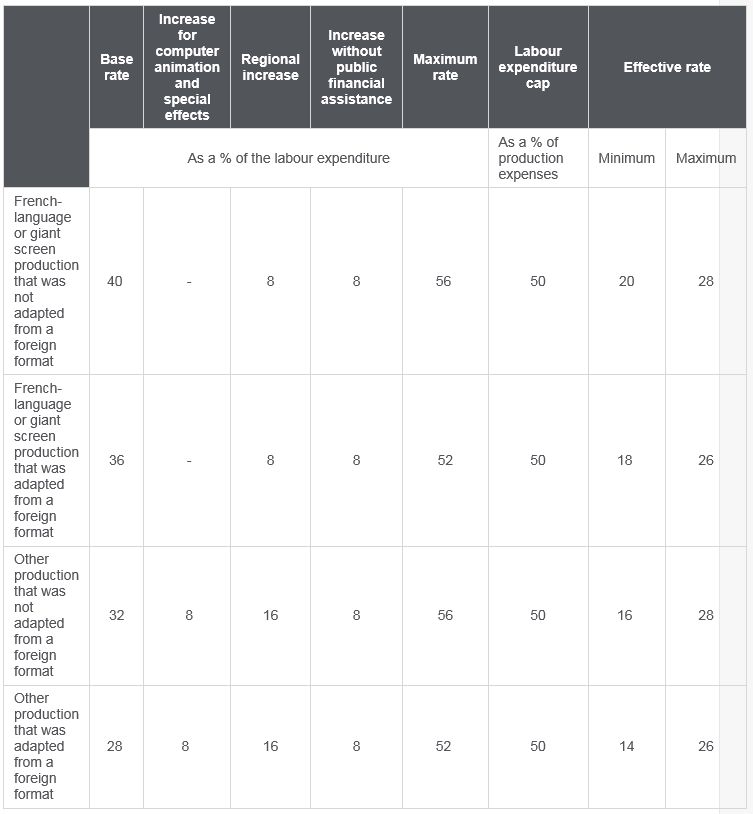

The base rates and the various rate increases for the refundable tax credit for Quebec film or television production will be amended. In addition, the Act respecting the sectoral parameters of certain fiscal measures will be amended to introduce a new category of films. The amendments are reflected in the following table:

Refundable tax credit for Quebec film and television production

The base rates and the various rate increases for the refundable tax credit for Quebec film or television production will be amended. In addition, the Act respecting the sectoral parameters of certain fiscal measures will be amended to introduce a new category of films. The amendments are reflected in the following table:

Refundable tax credit for sound recording production, refundable tax credit for the production of performances, refundable tax credit for film dubbing and refundable tax credit for the production of multimedia environments or events staged outside Quebec

At the time of Budget 2014-2015, the tax credits were reduced to a rate of 28% of the qualified labour expenditure. The tax legislation will be amended to restore the rate to 35%. In the case of the refundable tax rate for the production of performances, the maximum tax credit will be amended according to type of performance. In the case of the refundable tax credit for the production of multimedia environments or events staged outside Quebec, the tax legislation will be amended to eliminate the end date of the tax credit, which was set at January 1, 2016, and to increase the maximum tax credit from $280,000 to $350,000. With some exceptions, these amendments will come into force after the day of the Budget Speech.

Refundable tax credit for book publishing

As part of Budget 2014-2015, this credit was reduced to 28% of the qualified labour expenditure regarding the preparation costs and digital version publishing costs or 21.6% of the qualified labour expenditure regarding printing and reprinting costs. The tax legislation will be amended to restore the former rates of 35% and 27%, respectively. Moreover, the maximum tax credit will be increased from $350,000 to $437,500. With some exceptions, this amendment will come into force after the day of the Budget Speech.

Replacement of the refundable tax credit for international financial centres (IFCs)

Major amendments will be made to the refundable tax credit for IFCs in order to replace it almost entirely with a non-refundable tax credit. Only back office activities concerning qualified international financial transactions (QIFTs) will continue to give entitlement to a refundable tax credit.

A corporation all of whose activities qualify as QIFTs (except for those that consist of back office activities) will be able to claim the new, non-refundable tax credit. All of the conditions contained in the tax legislation that pertain to the refundable tax credit for IFCs will apply to the new, non-refundable tax credit, with the necessary adaptations. The unused portion of this credit will be able to be carried back three taxation years or carried forward 20 taxation years.

Measures to ensure the integrity of the tax system

Interposition of a trust or partnership for the purposes of preferential tax measures

Under Budget 2015-2016, legislative amendments will be made to improve the consistency of the integrity rules pertaining to preferential tax measures (particularly certain tax credits) in the more specific context of legal structures involving the interposition of a trust or partnership. The tax legislation will be amended to deem the attributes of a trust or partnership to be those of a corporation for the purposes of the integrity rules pertaining to preferential tax measures that call into play the notions “control of a corporation,” “persons not dealing at arm’s length,” “associated corporation” or “corporation exempt from tax.” These amendments will apply to a taxation year of an individual’s or a corporation’s taxation year ending after the day of the Budget Speech.

Furthermore, the interposition of a partnership is not treated in the same way for the purposes of these refundable tax credits and can result in a variation in the level of tax assistance compared to when an activity is carried on through the intermediary of a corporation. The tax legislation will be amended so that a partnership will qualify for the purposes of a refundable tax credit only if, were it a corporation, it would qualify. The level of tax assistance under a refundable tax credit that allows for an activity to be carried on through the intermediary of a partnership will be calculated by considering the partnership’s attributes to be those of a qualified corporation. These amendments will apply to an individual’s or a corporation’s taxation year beginning after the day of the Budget Speech that includes the end of a fiscal period of a partnership to which these amendments apply.

Change to the calculation of a taxable benefit of an employee for the purposes of a refundable tax credit

The tax legislation will be amended to specify the elements that must be taken into account in the calculation of a taxable benefit of an employee for the purposes of a refundable tax credit. A general amendment will be made to the tax legislation so that the value of a taxable benefit may be factored into the calculation of an employee’s salary or wages for the purposes of a refundable tax credit only where the employer paid the value of the benefit by means of a monetary amount. This amendment will apply to a taxpayer’s taxation year beginning after the day of the Budget Speech.

Changes to the rules pertaining to the 12-month time period for applying for a refundable tax credit

Under a general rule applicable to all refundable tax credits for businesses, applications for the tax credit must be submitted to Revenu Québec no later than 12 months after the filing due date for a taxation year to which a refundable tax credit applies. However, eligibility for certain refundable tax credits hinges on first receiving a document issued by a sectoral body, other than Revenu Québec, in accordance with the provisions of the Act respecting the sectoral parameters of certain fiscal measures. The Taxation Act already provides for two exceptions to take into account the fact that the examination of applications for such documents sometimes entails delays for the taxpayer.

The Act respecting the sectoral parameters of certain fiscal measures will be amended to add certain exceptions when a taxpayer is required to obtain such a document from a sectoral body. These amendments will apply to a taxpayer’s taxation year beginning after the Budget Speech.

Changes to the compulsory disclosure mechanism for certain transactions

On October 15, 2009, a number of measures to combat aggressive tax planning (ATP) schemes more effectively were announced, including a compulsory disclosure mechanism for certain transactions. Briefly, two types of transactions are covered by this compulsory disclosure mechanism: a transaction regarding which the advisor requires confidentiality on the part of the client and a transaction for which the advisor’s remuneration is conditional on the occurrence of certain events. The tax legislation will be amended to stipulate that a transaction involving contractual coverage1 is subject to the compulsory disclosure mechanism where the transaction results in a tax benefit of $25,000 or more for the taxpayer or in an impact on the income of the taxpayer of $100,000.

These amendments to the compulsory disclosure mechanism will apply to transactions carried out as of the day of the Budget Speech. However, they will not apply to transaction carried out as part of a series of transactions that began before the day of the Budget Speech and will be completed before July 1, 2015.

Easing of the tax provisions applicable to the transfer of family businesses

The Taxation Act stipulates that the gain realized on the disposition of shares to a corporation with which an individual is not dealing at arm’s length will generally be treated as a deemed dividend. Moreover, certain provisions do not allow an individual to claim a capital gain on the disposition of qualified shares to a corporation with which the individual is not dealing at arm’s length. Amendments will be made to the Taxation Act to provide that these rules do not apply in the case of a transfer of a family business, where the seller claims the capital gains exemption in respect of a capital gain resulting from the disposition of “qualified shares in the primary and manufacturing sectors.”

For the purposes of this tax measure, a “qualified share of the primary and manufacturing sectors” will mean:

- a share of the capital stock of a family farm corporation;

- a share of the capital stock of a family fishing corporation;

- a qualified small business corporation share of a corporation in the primary or manufacturing sector.

For the purposes of this tax measure, “corporation in the primary or manufacturing sector” will mean a corporation of which over 50% of the fair market value of the assets is attributable to assets used in the primary or manufacturing sectors.

As for the concept of a “transfer of a qualified family business,” the minister of finance will announce, within one year, the qualification criteria and the name of the body responsible for issuing the qualification certificate. These amendments will apply to dispositions of shares carried out after December 31, 2016.

Measures for individuals

- Gradual elimination of the healthcare contribution starting on January 1, 2017, and ending on 2019;

- Enhancement of the tax credit for experienced workers;

- Introduction of a “tax shield” to offset part of the loss of socio-fiscal transfers further to an increase in work income;

- Increase in the eligibility age for the tax credit with respect to age;

- Review of the operating terms of the solidarity tax credit;

- New assistance program for seniors to partially offset a municipal tax increase pursuant to a new assessment roll.

Fight against tax evasion

Budget 2015-2016 introduces new initiatives to fight tax evasion, particularly in the construction industry, including:

- redirecting the work of the ACCES construction committee;

- tightening verification of requirements for holding a contractor’s licence; and

- conducting a consumer awareness campaign.

Footnote

1. Contractual coverage means insurance or any kind of coverage, including an indemnity, compensation or a guarantee that would serve to either protect the taxpayer from any failure of the transaction to produce a tax benefit or to pay or refund any amount that may be incurred by the taxpayer in a dispute with a tax authority.

Norton Rose Fulbright Canada LLP

Norton Rose Fulbright is a global legal practice. We provide the world’s pre-eminent corporations and financial institutions with a full business law service. We have more than 3800 lawyers based in over 50 cities across Europe, the United States, Canada, Latin America, Asia, Australia, Africa, the Middle East and Central Asia.

Recognized for our industry focus, we are strong across all the key industry sectors: financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and life sciences and healthcare.

Wherever we are, we operate in accordance with our global business principles of quality, unity and integrity. We aim to provide the highest possible standard of legal service in each of our offices and to maintain that level of quality at every point of contact.

Norton Rose Fulbright LLP, Norton Rose Fulbright Australia, Norton Rose Fulbright Canada LLP, Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) and Fulbright & Jaworski LLP, each of which is a separate legal entity, are members (‘the Norton Rose Fulbright members’) of Norton Rose Fulbright Verein, a Swiss Verein. Norton Rose Fulbright Verein helps coordinate the activities of the Norton Rose Fulbright members but does not itself provide legal services to clients.