Introduction

This briefing note contains comparisons of the rates of tax affecting two types of business structure for a typical UK trading or professional business with UK resident owners and employees. It does not cover situations involving special types of activity that can attract particular tax rates (for example where the bank payroll tax or debt cap restrictions apply for corporates), nor the availability of loss reliefs to offset taxable profits (for example group relief in the context of companies, or sideways loss relief in the context of individuals).

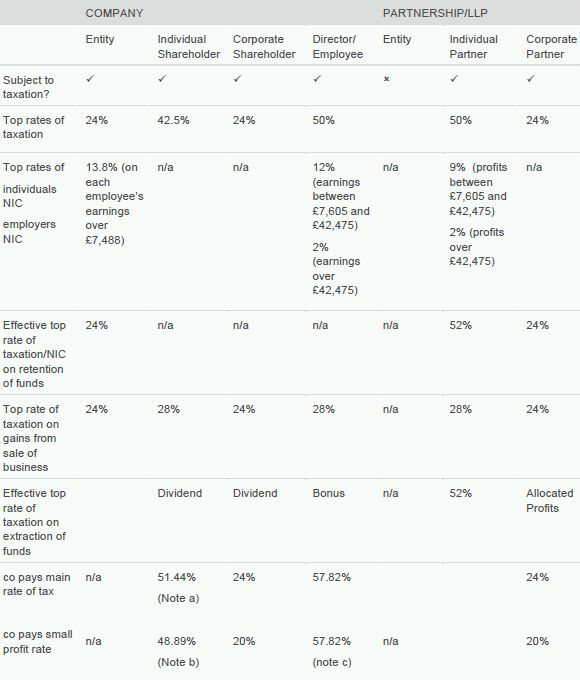

Comparison of top rates of tax

This table compares the top rates of tax using a limited company structure or a partnership structure. The comparison is made in the context of different types of stakeholder. In the context of a company the rates applicable to stakeholders are compared for the entity itself, an individual shareholder, a corporate shareholder and a director employee. In the context of a partnership the rates applicable to stakeholders are compared for the entity itself, an individual partner and a corporate partner.

In the context of individuals, no account is taken of the marginal rates that can apply where personal allowances are withdrawn, nor interaction with any restriction of relief for pension contributions. In the context of a corporate shareholder it is assumed that any dividends received would qualify for one of the dividend exemption categories in CTA09 part 9A.

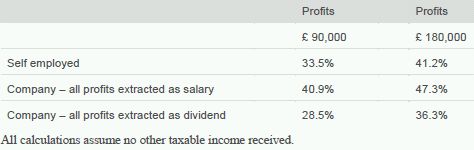

Comparison of effective rates of tax

This table compares the rates of tax on extraction of profits by a UK resident individual from a business and two different profit levels in the following circumstances:

- a non-corporate business, for example a self employed person;

- a business undertaken through a company where all profits are extracted via salary payments;

- a business undertaken through a company where all profits are extracted via dividend.

In calculating the tax rates in each case the following assumptions have been made:

- the individual is able to extract all taxable profits from the business;

- the individual has no other income or gains and no access to any tax reliefs;

- the individual has a standard personal allowance;

- the company (where there is one) is subject to the small company rate of corporation tax.

Please note the effective tax rates will change according to different profit levels, the extent to which any reliefs are available, and the level of other income and gains received by the individual.

Top Rates of Tax

Note: The table shows the effective rates on the top slices of income and various simplifying assumptions have been used.

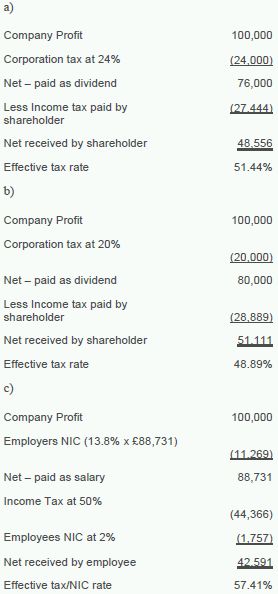

Notes to Top Rates of Tax table:

Comparison of effective rates of tax