Both domestic and foreign invested enterprises are subject to several taxes, including corporate income tax, import and export taxes, and value added tax, and their employees are subject to personal income tax. Depending on the nature of its business, an enterprise may be subject to other taxes such as natural resource tax, special consumption tax, and foreign contractor tax. Some significant tax reform was introduced as a result of four laws: the Law on Corporate Income Tax (“LCIT”), the Law on Value Added Tax (“LVAT”) and the Law on Personal Income Tax (“LPIT”) which came into effect on January 1, 2009, and the amended LPIT which came into effect on July 1, 2013, the amended LCIT and the amended LVAT which comes into effect on January 1, 2014.

Tax incentives – mainly in the form of preferential tax rates, tax exemptions and tax reductions – depend mainly on the location and type of business in which a company is engaged and on standard incentives which the Government grants. They are discussed in more detail in Chapter One.

2.1 Corporate income tax (“CIT”)

CIT calculation is based on assessable income and the CIT rate. CIT payable is assessable income multiplied by the CIT rate.

2.1.1 Assessable income

Assessable income within any one tax period is equal to taxable income minus tax exempt income and losses carried forward.

2.1.1.1 Taxable income

Taxable income includes business and other income . In particular, taxable income is turnover minus deductible expenses plus other income (including income received from outside of Vietnam).

Turnover

Turnover is the total sum earned from the sale of goods or services, processing fees, surcharges, additional charges and fees to which a taxpayer is entitled.

Deductible expenses

Since January 1, 2009, under the LCIT, a taxpayer has been entitled to deduct all expenses (instead of only “reasonable” expenses as specified in the prior law) provided that such expenses are (i) actual and related to the taxpayer’s operation, (ii) can be established by proper invoices, vouchers, and payment via bank transfer for invoices with a value of VND20 billion or more, and (iii) are not classified as non-deductible expenses as described below.

Non-deductible expenses

Non-deductible expenses include:

- Expenses that fail to meet the conditions of a deductible expense (except for damages resulting from natural calamity, epidemics and other force majeure events);

- Expenses payable for administrative fines;

- Expenses covered by other funding sources;

- That part of management expenses incurred by a foreign company allocated to a permanent establishment in Vietnam, which exceed the level calculated by the allocation method under Vietnamese law;

- Expenses that exceed the level of provisional reserves set out by law;

- Interest payable to a non-credit organization or an economic entity, that exceeds 150% of the base interest rate announced by SBVN at the time the loan was made;

- Depreciation or amortization made contrary to law;

- Accrued expenses made contrary to law;

- Salary, remuneration paid to an owner of a private enterprise; remuneration paid to founding members of an enterprise who do not manage the business; salary, remuneration and other compensation recorded as expenses paid to employees but not actually paid, or which lack the vouchers, documentation required by law;

- Interest payable for loan capital which is used in place of the amount of charter capital which has not been paid in;

- Input VAT that has been credited, output VAT paid in accordance with the deduction method, corporate income tax;

- That part of expenses for advertisement, commercial promotion, brokerage commission, public affairs, conferences; marketing support expenses, other support expenses which exceed 15% of all deductible expenses23;

- Financial aid (except for financial aid for education, health care, scientific studies, relief for natural disasters and construction of charitable homes, state programs applicable to geographical locations with special socio-economic difficulties);

- Provisions for volunteer pension funds or social security funds, contributions to volunteer pension funds for employees to the extent that the contributions exceed the statutory levels;

- Expenses for business activities such as: banking, insurance, lotteries, securities and other special business activities as stipulated in regulations issued by the Ministry of Finance.

2.1.1.2 Tax exempt income

To determine assessable income for any tax period, a taxpayer is entitled to deduct the following income:

- Income from cultivation, husbandry and aquaculture and salt production of cooperatives; income from cooperatives which engage in the agriculture., forestry, fish-breeding, salt-production businesses in geographical locations with special socio-economic difficulties or in geographical locations with socio-economic difficulties; income from cultivation, husbandry and aquaculture received by enterprises operating in geographical locations with special socio-economic difficulties; income from fisheries and agricultural activities.

- Income from the performance of a technical service contract that directly serves agriculture.

- Income from the performance of contracts that relate to scientific research and technological development, products made within a trial period, and products made with technologies used for the first time in Vietnam.

- Production and trading of goods or service activities received by enterprises with 30% or more of their average number of employees in a year being disabled people, people in post-detoxification, or who are HIV-infected which enterprises employ an average number of 20 or more employees in a year, and this tax exemption does not apply to enterprises which operate in the finance or real estate business.

- Income from job-training activities that relate exclusively to ethnic minorities, the disabled, extremely disadvantaged children, and persons involved in social evils.

- Income received from capital contribution to joint ventures or associations with domestic enterprises, after such enterprises have paid corporate income tax.

- Financial support received and used for education, scientific research, or cultural, artistic, charitable, humanitarian and other social activities in Vietnam.

- Income received from the transfer of certified emission reductions.

- Income from the performance of duties assigned by the State to the Vietnam Development Bank; income from lending activities to poor people; income from state financial funds which operate for non-profit purposes; income received by 100% state owned organizations which are established in order to settle bad debts of Vietnamese credit organizations.

- Undistributed income of establishments which perform socialized programs in education-training, medical and other socialized sectors, and which is used to develop such establishments; and the portion of income used to form undistributed assets of cooperatives established under the Law on Cooperatives.

- Income received from the transfer of technology in sectors which are encouraged to transfer to organizations, individuals which locate or reside in geographical locations with special socio-economic difficulties.

2.1.1.3 Loss carry forward

If an enterprise suffers losses, it is permitted to carry its losses forward to the following year, and the amount of the losses may be set off against assessable income. The continuous duration of loss carry forward may not exceed five years.

2.1.2 CIT rate

The standard CIT rate is 25%. With effect from July 1, 2013, a lower rate of 20% is applicable to small and medium enterprises and a lower rate of 10% is applicable to enterprises24 which develop social residential houses. The standard CIT rate of 25% is reduced to 22% with effect from January 1, 2014, and will be further reduced to 20% from January 1, 2016. The CIT rate applicable to business establishments which conduct exploration and exploitation of oil and gas and other valuable and rare natural resources, ranges from 32% to 50%.

Preferential CIT rates of 20% and 10%, in the form of incentives, apply if the enterprise meets certain specific criteria. The tax incentive period starts from the first year in which the enterprise generates revenue or from the date on which the enterprise receives a certificate of high-tech enterprise. See Appendix 2 to Chapter One.

2.1.3 Tax exemption and reduction

Enterprises that receive preferential CIT rates because they qualify for tax incentives enjoy CIT preferences for a certain number of years. Depending on the nature of the investment, sector and location, an enterprise can enjoy a maximum 4-year period of CIT exemption, plus a 50% CIT reduction period for up to nine more years. See Appendix 2 to Chapter One.

2.1.4 Place to pay CIT

A taxpayer is required to pay CIT to the tax authority where its head office is located, but it must also allocate its CIT payments among the tax authorities where its manufacturing facilities are located. The allocation is made pro rata on the basis of expenses. The purpose of the rule is to distribute tax collections to provinces in which the taxpayer’s manufacturing facilities are located.

2.2 Export tax and import tax

The Law on Export Tax and Import Tax of the Government (June 14, 2005) provides incentives in the nature of lower export and import taxes. Generally, all goods which The Law on Export Tax and Import Tax of the Government (June 14, 2005) provides incentives in the nature of lower export and import taxes. Generally, all goods which enterprises are permitted to export and/or import, including goods sold to enterprises in EPZs and/or goods sold by enterprises in EPZs, are subject to export and/or import tax pursuant to the Law on Export Tax and Import Tax. There are some exemptions.

2.2.1 Export tax

Most finished products, if exported, are subject to an export tax rate of 0%. Enterprises that export in the circumstances described below are exempt from export tax:

- Materials, raw materials, semi-finished products sold by enterprises to EPZs and that are used to produce and/or process exported goods;

- Products that are exported back to foreign parties under signed processing contracts.

2.2.2 Import tax

Enterprises are exempt from import tax in the following circumstances:

- Goods imported to create fixed assets of projects funded by Official Development Aid (ODA), of projects invested in certain business sectors and in certain geographical areas which are eligible for preferential import tax;

- Certain equipment imported to create fixed assets of projects which are eligible for preferential import tax and of projects funded by ODA on hotels, offices, apartments for lease, residential housing, commercial centers, technical services, supermarkets, golf courses, resorts, entertainment areas, medical, training, cultural, financial, banking, insurances, auditing and consulting services (tax exemption applies to first-time import. It does not apply to replacements.);

- Plant varieties and animal breeds imported for use in investment projects in agriculture, forestry or fisheries;

- Goods imported to support petroleum activities;

- Raw materials and supplies not yet available in Vietnam for direct service in the manufacture of software;

- Goods imported for direct use in scientific research and technological development (including equipment, machinery, spare-parts, materials, transportation means which cannot be made in Vietnam, technology which is not yet available domestically; and scientific magazines, books, and technological and scientific data);

- Equipment, facilities, and forms of transportation of a technological nature used to form fixed assets in connection with shipbuilding (including raw materials, materials and semi-finished products which are not yet able to be produced domestically);

- Goods imported to be processed for export for foreign parties under signed processing contracts;

- Goods which are produced, processed, recycled or assembled in non-tariff zones without using raw materials or component parts imported from abroad and which are then “imported” into Vietnam for domestic use.

In addition, enterprises are exempt from import tax for five years after they commence production of raw materials, supplies and components which are not yet able to be produced domestically and which are imported for production under projects on the list of domains eligible for special investment encouragement; or on the list of geographical areas with extremely difficult socio-economic conditions (except for projects which produce or assemble automobiles, motorbikes, air conditioners, electric heaters, fans, irons, refrigerators, washing machines, dishwashers, disk players, stereo systems, water boilers, hairdryers and other goods as decided by the Prime Minister from time to time);

Enterprises will be reimbursed for import tax paid on goods temporarily imported for re-export and in other cases stipulated in the Law on Export Tax and Import Tax.

2.3 Value added tax (“VAT”)

Goods and services used for production, business and consumption in Vietnam are subject to VAT, except for some goods and services which are specifically exempt.

Most organizations that produce and trade in goods and services are subject to VAT. Under the VAT law, an enterprise is responsible to pay VAT if it sells goods/provides services in Vietnam. The VAT rate on exported goods/services is 0%, as discussed in more detail below.

2.3.1 VAT calculation bases

Calculation of VAT is based on two elements: taxable price and VAT rate.

2.3.1.1 Taxable price

Taxable price is the selling price for goods sold or services rendered, prior to inclusion of VAT. The taxable price of imported goods is the border-gate import price plus import tax.

2.3.1.2 VAT rates

Currently, VAT rates are 10%, 5% and 0%. The common rate is 10%. The 5% rate is limited to certain goods and services. The zero rate applies to:

- international transportation;

- exported goods and services (i.e. goods/services consumed outside of Vietnam or in duty-free zones; or goods/services provided to foreign customers pursuant to Government regulations) ); and

- goods and services which are not subject to VAT.

2.3.2 VAT payable

VAT payable is calculated by the deduction method, as stipulated in the Law on VAT. Briefly, the deduction method means that an enterprise’s VAT payable is output VAT (VAT received) minus deductible input VAT (VAT paid).

Output VAT is the taxable price of goods sold or services rendered, multiplied by the applicable VAT rate.

Deductible input VAT is determined on the basis of the amount of VAT paid by the enterprise. The amount appears on the VAT invoices that a seller issues to the enterprise.

2.3.3 Conditions to claim input VAT

A taxpayer that applies the deduction method is entitled to claim input VAT provided that it produces the following documentation:

- VAT invoices or tax receipts (for VAT paid at the time of import);

- Documents evidencing that payment for the goods/services that were purchased, was made through bank transfer (with a few exceptions);

- In case of exported goods/services, in addition to the documents described in the points above, the taxpayer must provide a customs declaration, sales contract, invoices and documents evidencing that payment for goods/services sold was made through bank transfer.

2.4 Personal income tax (“PIT”)

2.4.1 PIT payers

Vietnamese citizens living in Vietnam or working in foreign countries, expatriates working in Vietnam and receiving income, and/or expatriates whose income is derived from Vietnam (even if they do not live in Vietnam) are subject to PIT.

2.4.2 Assessable income

The computation of assessable income may vary depending on the kind of income. For example: with regard to salary and wages, certain amounts may be deducted before determining assessable income, including a personal deduction (VND9 million per month), deduction for each dependant (VND3.6 million per month) , charitable contributions, social insurance, health insurance and compulsory professional liability insurance.

With regard to business income, a taxpayer is entitled to deduct reasonable expenses that relate to creation of revenue, provided that the taxpayer implements the accounting regime in respect of invoices and vouchers. If a taxpayer fails to do so, the tax authorities are entitled to fix assessable income in respect of business income.

2.4.3 Income subject to PIT

Certain income is subject to personal income tax under the LPIT, eg, income from salary, remuneration, income from interest, dividends, sale of real estate, sale of securities, assignment of interest in an entity, inheritance, etc. Moreover, taxable income includes both monetary and non-monetary benefits. The term “non-monetary benefit” includes several items, eg, premium paid for non-compulsory insurance; membership fees; other services for individuals in healthcare, entertainment, sports and aesthetics; housing rent, electricity, water and other related services paid by the employer, accumulated premiums paid under a life insurance policy or under other types of voluntary insurance, accumulated contributions under a voluntary pension plan contributed to by employers for employees. Under the LPIT, the following items are taxable:

- Business income (eg, income from producing, trading goods, or providing services; income from independent professional activities, etc.);

- Income from salaries, wages and similar income; allowances and subsidies (with a few exceptions); brokerage commissions, payments for participation in projects, schemes, royalties and other remuneration; stipends paid for participation in business associations, boards of directors, control boards, management boards, associations, professional societies and other organizations; monetary or non-monetary benefits other than salaries and wages paid by employers to or on behalf of taxpayers in any form (except for organizational membership cards for common use; transportation for common use; mid-shift meal; training to improve an employee’s knowledge and skills; per diem expenses for travel, telephone, uniform, etc.). There are some exceptions that apply only to expatriates: a one-off relocation allowance; one round trip air ticket for annual leave; tuition paid by the employer for children, through high school level; house rental paid by the employer that exceeds 15% of total taxable income; monetary or non-monetary bonuses (including securities in lieu of bonus), etc.;

- Income from capital investments [eg, loan interest (except interest received from banks or from life insurance policies); dividends; income that represents an increase of the value of capital contribution in case of merger, dissolution, re-structure, consolidation or capital withdrawal)];

- Income from capital transfer (eg, transfer of interest in companies, cooperatives or other entities; sale of securities, etc.);

- Income from transfer of real estate (eg, transfer of land use rights, transfer of land use rights plus assets attached to the land; transfer of house ownership; transfer of the right to lease a house/land/water surface, etc.);

- Income from winnings (eg, lottery, prizes received from commercial promotions, winnings from legal betting; winnings from casinos, etc.)

- Income from royalties (eg, use fees, assignment of rights in respect of intellectual property assets, technology transfer, etc.);

- Income from commercial franchises;

- Income from inheritance (eg, securities, real estate, interest in an entity, etc.); and

- Income from receipt of gifts (eg, securities, real estate, interest in an entity, etc.).

In the case of a resident, taxable income includes income generated both inside and outside of Vietnam, regardless of the place where it is paid or received.

In the case of a non-resident, taxable income includes income generated from Vietnam, again, regardless of the place where it is paid or received.

An expatriate is taxed with reference to the duration of his stay in Vietnam or the nature of his residence in Vietnam. Depending on these two factors, personal income is taxed at a partially progressive rate described at point 2.4.3.1 below, or at a flat rate.

- If an expatriate stays in Vietnam for 183 days or more during a period of 12 consecutive months counting from the date of his arrival or during a calendar year, or if he leases a house with a term of more than 183 days, or if he has registered a permanent residence in Vietnam, then for tax purposes, he is considered to be a resident of Vietnam , and is taxed on his worldwide income at the partially progressive rates listed in Section 2.4.3.1.

- If an expatriate is not a resident, as defined above, his income is taxable on the basis of gross income at the following flat rates:

| Income from | Rate (%) |

| Trading in goods | 1 |

| Services | 5 |

| Manufacturing, construction, transportation and other businesses | 2 |

| Royalty, franchising fees (except contractual income less than VND10 million ) | 5 |

| Salaries, remuneration generated from Vietnam (regardless of place of payment/receipt ) | 20 |

| Capital investments (dividends/interest) | 5 |

| Inheritance | 10 |

| Sale of securities/transfer of interest in an entity | 0.1 |

| Sale of real estate | 2 |

2.4.3.1 Tax rate for residents

- The tax on a resident’s business income, including salary and wages, is calculated on the basis of partially progressive rates and on average monthly assessable income.

There is no difference between a resident-expatriate and a Vietnamese taxpayer as far as tax rates are concerned. The same partially progressive rates apply equally to assessable income of both Vietnamese and resident expatriate taxpayers. See table below:

| Tax bracket | Annual assessable income (million VND) | Monthly assessable income (million VND) | Rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Over 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

- The tax on other income of a resident is determined on the basis of the type of assessable income and flat rates. See table below:

| Assessable Income | Rate (%) |

| Capital investments [dividends, interest (except on bank deposits and life insurance policies)] | 5 |

| Royalty, franchising fees (except income less than VND10 million) | 5 |

| Inheritance, winnings and gifts | 10 |

| Sale of securities/assignment of interest in an entity | |

|

20 |

|

0.131 |

| Sale of real estate (with a few exceptions) | |

|

25 |

|

232 |

- Individuals (regardless of whether they are Vietnamese or expatriates) who work in all economic zones are entitled to a 50% reduction of their PIT.

2.4.3.2 Non-taxable compensation

The following incomes and allowances paid to employees (whether Vietnamese or expatriates) are tax free:

- Mid-shift meal within the permitted cap;

- Training to improve employee’s knowledge and skills;

- Per diem expenses for telephone, uniform, stationary, etc. within the permitted cap;

- Travel expenses for business trips;

- The positive difference between income from night-shift or overtime payment and the day shift payment or the salary payment for normal working hours;

- Allowances given to employees who work under hardship conditions in remote areas, offshore areas, etc. and in a toxic or dangerous environment;

- Allowances as set out in the Labor Code and in the Law on Social Insurance: one-off payment for delivery of a child or for adopting a child; one-off payment on retirement and monthly death gratuity, severance allowance, retrenchment allowance, unemployment allowance, etc.;

- Pension paid by the Social Insurance Fund.

Some compensation is non-taxable only to expatriates or Vietnamese working overseas:

- One round trip air ticket for annual leave;

- Tuition paid by the employer for the employee’s children, through primary and secondary education level;

- Compulsory insurance paid in a foreign country.

Of course, the expatriate is obliged to provide documents and receipts (e,g, employment contract, air ticket, receipt for tuition, insurance receipts etc.).

2.4.3.3. Examples

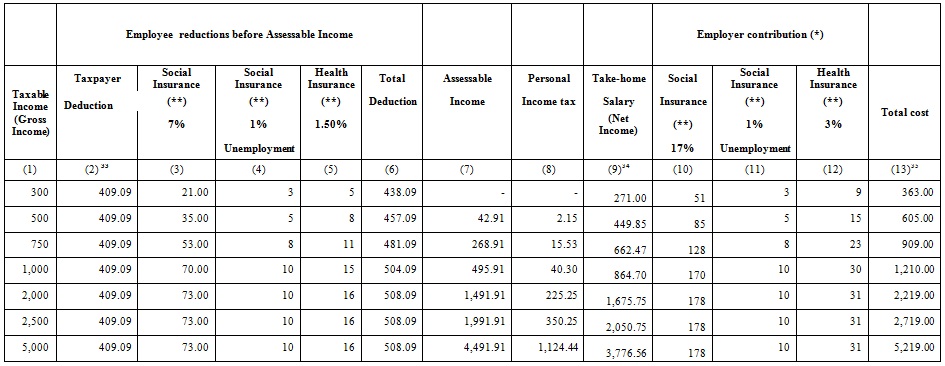

Following are examples of the PIT obligation which applies to seven different levels of income. The presentation is on a monthly tax basis and is made in US dollars rather than Vietnamese dong. Payment, however, must be made in Vietnamese dong. In order to calculate tax rates, we have converted Vietnamese dong to US dollars in this table at the rate of US$1 = VND22,000.

Please refer to the next page.

Note that:

( * ) There is no statutory requirement for an employer to contribute/deduct social, and unemployment insurance of an expatriate.

( ** ) The Law on Social Insurance and the Law on Health Insurance set a ceiling on the salary on which contributions by both employers and employees will be calculated, and beyond which no contribution need be made. Contributions and payment of social insurance benefits/unemployment insurance are based on employees’ monthly salary. If total salary on which contributions are based is higher than twenty times the Government’s general minimum wage36 , then for purposes of calculating social insurance contributions/benefits, salary will be deemed to be fixed at twenty times the general minimum wage (“maximum contribution salary”). Based on a current general minimum wage of VND 1,050,000 per month, the maximum contribution salary fixed as of May 1, 2012 is VND 21,000,000.37

2.5 Tax treaties

Vietnam has signed treaties on avoidance of double taxation with many countries. Expatriates living in Vietnam who are residents of any treaty partners are allowed to deduct tax paid in their home country from their Vietnamese tax obligation. Certain conditions have to be met in order to qualify. Of course, treaties on avoidance of double taxation affect many rules and regulations that regulate CIT and other forms of taxation.

Following is a list of countries that have signed treaties on avoidance of double taxation.

| No. | Country | Date Signed | Effective date |

| 1 | Algeria | 6/12/1999 Algiers | Not yet effective |

| 2 | Australia | 13/10/1992 Hanoi | 30/12/1992 |

| 3 | Austria | 2/6/2008 Vienna | 01/01/2010 |

| 4 | Bangladesh | 22/3/2004 Dhaka | 19/08/2005 |

| 5 | Belarus | 24/4/1997 Hanoi | 26/12/1997 |

| 6 | Belgium | 28/2/1996 Hanoi

Amended Protocol: 12/3/2012 Hanoi |

25/06/1999

The amended Protocol: Not effective yet |

| 7 | Bulgaria | 24/5/1996 Hanoi | 04/10/1996 |

| 8 | China | 17/5/1995 Beijing | 18/10/1996 |

| Canada | 14/11/1997 Hanoi | 16/12/1998 | |

| 10 | Cuba | 26/10/2002 Havana | 26/06/2003 |

| 11 | Czech Republic | 23/5/1997 Hanoi | 03/02/1998 |

| 12 | Denmark | 31/5/1995 Copenhagen | 24/04/1996 |

| 13 | Egypt | 6/3/2006 Cairo | Not yet effective |

| 14 | Finland | 21/11/2001 Helsinki | 26/12/2002 |

| 15 | France | 10/02/1993 Hanoi | 01/07/1994 |

| 16 | Germany | 16/11/1995 Hanoi | 27/12/1996 |

| 17 | Hong Kong | 16/12/2008 Hanoi | 12/08/2009 |

| 18 | Hungary | 26/8/1994 Budapest | 30/06/1995 |

| 19 | Iceland | 3/4/2002 Hanoi | 27/12/2002 |

| 20 | India | 7/9/1994 Hanoi | 02/02/1995 |

| 21 | Indonesia | 22/12/1997 Hanoi | 10/02/1999 |

| 22 | Ireland | 10/3/2008 Dublin | 01/01/2009 |

| 23 | Israel | 4/8/2009 Hanoi | 24/12/2009 |

| 24 | Italy | 26/11/1996 Hanoi | 20/02/1999 |

| 25 | Japan | 24/10/1995 Hanoi | 31/12/1995 |

| 26 | Kazakhstan | 31/10/2011 Hanoi | Not yet effective |

| 27 | Korea (South) | 20/5/1994 Hanoi | 11/09/1994 |

| 28 | Korea (North) | 3/5/2002 Pyongyang | 12/08/2007 |

| 29 | Kuwait | 10/03/2009 Kuwait | 11/02/2011 |

| 30 | Laos | 14/1/1996 Vientiane | 30/9/1996 |

| 31 | Luxembourg | 4/3/1996 Hanoi | 19/5/1998 |

| 32 | Malaysia | 7/9/1995 Kuala Lumpur | 13/8/1996 |

| 33 | Mongolia | 9/5/1996 Ulan Bator | 11/10/1996 |

| 34 | Morocco | 24/11/2008 Hanoi | 12/09/2012 |

| 35 | Mozambique | 3/9/2010 Hanoi | Not yet effective |

| 36 | Myanmar | 12/5/2000 Yangon | 12/8/2003 |

| 37 | Negara Brunei Darussalam | 16/8/2007 Bandar Seri Begawan | 01/01/2009 |

| 38 | Norway | 1/6/1995 Oslo | 14/4/1996 |

| 39 | Oman | 18/4/2008 Hanoi | 01/01/2009 |

| 40 | Pakistan | 25/3/2004 Islamabad | 04/2/2005 |

| 41 | Philippines | 14/11/2001 Manila | 29/9/2003 |

| 42 | Poland | 31/8/1994 Warsaw | 28/1/1995 |

| 43 | Qatar | 8/03/2009 | 16/3/2011 |

| 44 | Republic of Serbia | 01/3/2013 Hanoi | Not yet effective |

| 45 | Republic of Seychelles | 4/10/2005 Hanoi | 07/7/2006 |

| 46 | Romania | 8/7/1995 Hanoi | 24/4/1996 |

| 47 | Russia | 27/5/1993 Hanoi | 21/3/1996 |

| 48 | San Marino | 14/02/2013 Roma | Not yet effective |

| 49 | Saudi Arabia | 10/4/2010 Riyadh | 01/02/2011 |

| 50 | Singapore | 02/3/1994 Hanoi | 09/9/1994 |

| 51 | Slovak Republic | 27/10/2008 Hanoi | 29/7/2009 |

| 52 | Spain | 07/3/2005 Hanoi | 22/12/2005 |

| 53 | Sri Lanka | 26/10/2005 Hanoi | 28/9/2006 |

| 54 | Sweden | 24/3/1994 Stockholm | 08/8/1994 |

| 55 | Switzerland | 6/5/1996 Hanoi | 12/10/1997 |

| 56 | Taiwan | 6/4/1998 Hanoi | 06/5/1998 |

| 57 | Thailand | 23/12/1992 Hanoi | 29/12/1992 |

| 58 | Tunisia | 13/4/2010 Tunis | 06/3/2013 |

| 59 | The Netherlands | 24/1/1995 Hague | 25/10/1995 |

| 60 | UAE | 16/2/2009 Dubai | 12/4/2010 |

| 61 | Ukraine | 08/4/1996 Hanoi | 22/11/1996 |

| 62 | United Kingdom | 09/4/1994 Hanoi | 15/12/1994 |

| 63 | Uzbekistan | 28/3/1996 Hanoi | 16/8/1996 |

| 64 | Venezuela | 20/11/2008 Caracas | 26/5/2009 |

Vietnam has not yet signed such a treaty with the United States.

Footnotes

22The concept of “other income”, as defined in the amended LCIT, includes income which appears in italics in this footnote: incomes derived from capital gains, from the transfer of real estate; interest income, sale of foreign exchange; collection of bad debts which have been written off; income from liabilities in situations in which creditors have not been identified; income recaptured from previous fiscal years and other incomes, including income from operation outside of Vietnam; income derived from the right to use/own assets, income from the assignment, lease, liquidation of assets (including valuable papers); income derived from transfer of the right to contribute capital; investment projects; the right to participate in an investment project a concession to explore, exploit and process minerals; income deriving from intellectual properties.

23In the case of a trading entity, deductible expenses must exclude cost of goods sold.

24Enterprises have annual revenues of less than VND20 billion.

25The list of projects which are eligible for preferential import tax was issued together with Government Decree 87/2010/ND-CP dated August 13, 2010 (“Decree 87”).

26The list of geographical areas was issued together with Government Decree 124/2008/ND-CP (December 11, 2008) amended by Government Decree 53/2010/ND-CP dated May 19, 2010 and Government Decree 122/2011 dated December 27, 2011.

27The list of equipment and facilities entitled to import tax exemption was issued together with Decree 87.

28The list of geographical areas was issued together with Decree 87.

29When the CPI changes by 20%, the deduction for each dependant will be adjusted accordingly based on the Government’s suggestion and subject to approval of the Standing Committee of the National Assembly (to be applied the following tax period).

30If an expatriate who has a permanent residence in Vietnam or who leases a house to live in, with a term of more than 183 days but in fact is present in Vietnam less than 183 days, he is still considered to be a resident of Vietnam for tax purposes unless he can prove that he is a resident of another country.

31This rate applies in case the purchase price and related expenses cannot be determined.

32This rate applies in case the purchase price and related expenses cannot be determined.

33Every taxpayer is entitled to a deduction of VND 9 million (equivalent to US$409.09) per month when calculating his or her assessable income for his/her own personal expenses.

34(9) = (1) – (3) – (4) – (5) – (8)

35(13) = (1) + (10) + (11) + (12)

36The Government’s general minimum salary is the minimum salary fixed by the Government from time to time. It is a minimum base on which government salaries and allowances are fixed.

37Government Decree No. 31/2012/N?-CP on the minimum wage dated 12 April 2012.