New SDLT Regime for UK Residential Property

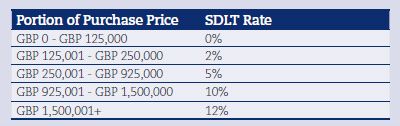

On 3 December 2014, the Government announced fundamental and important changes to the stamp duty land tax (“SDLT”) rules applying to purchases of UK residential property. With effect from 4 December 2015, the rate of SDLT payable is now dependant on the portion of the purchase price which falls within specific bands, and is no longer a single flat rate on the total purchase price. The new rates and thresholds are as set out below.

The impact of the new SDLT regime will depend on the purchase price of the residential property. If the purchase price is below GBP 937,500 the purchaser will pay the same SDLT or less under the new regime, as compared to the old regime. However, if the purchase price is more than GBP 937,500, the new SDLT regime will result in a higher SDLT liability as compared to the old regime.

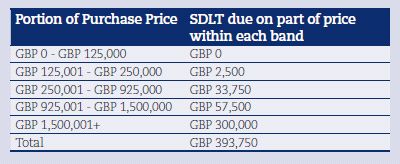

For example, under the old regime if an individual purchased a residential property for GBP 4,000,000 he was liable to pay SDLT at a rate of 7% on the total value of the chargeable consideration i.e. GBP 280,000. By contrast, under the new regime the amount of SDLT will be:

This example shows that under the new regime, if an individual purchases a UK residential property for GBP 4 million, he will be liable to pay an additional GBP 113,750 of SDLT (as compared to the old regime). This substantial increase in the SDLT payable on residential properties worth more than GBP 937,500 (the great majority of which will be in London) suggests the new regime is in effect a “mansion tax on Londoners”.

SDLT – Transitional Reliefs

Where contracts for the purchase of a residential property were exchanged on or before 4 December 2014 but the contract is completed on or after that date, purchasers can choose whether to apply the new SDLT rules or the old SDLT rules.

SDLT – Enveloped Dwellings

The Finance Act 2012 enacted changes to discourage taxpayers from avoiding SDLT by purchasing residential properties in “corporate wrappers” (or “corporate envelopes”) and then selling the shares in the corporate wrapper rather the property. Briefly, under these rules a 15% higher rate of SDLT applies to residential property bought by a ‘non-natural person’ (e.g. a company or a collective investment scheme) where the chargeable consideration for the property exceeds GBP 500,000. This higher rate of SDLT has not been affected by the recent change in the SDLT regime announced on 3 December 2014. Therefore, where none of the reliefs (e.g. for a property rental business) from the 15% higher rate apply the SDLT position of companies (or other ‘non-natural persons’) who fall under this charge remains unchanged.

If eligible for relief from the 15% higher SDLT charge, a company (or other ‘non-natural persons’) will be subject to the same new regime that applies to individuals. As a result, if a company (or other ‘non-natural person’) purchases a property where the chargeable consideration is more than GBP 937,500, the new SDLT regime will impose a much higher SDLT liability on the taxpayer than under the old regime (please refer to the example above).

Annual Tax on Enveloped Dwellings (ATED)

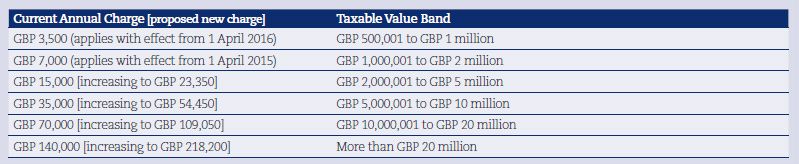

As part of the package of anti-avoidance reforms to discourage taxpayers from purchasing and holding UK residential property in “corporate envelopes” the Finance Act 2013, enacted rules providing for an annual tax on enveloped dwellings – the so-called “ATED charge”. The annual charge is calculated by reference to the taxable value of the dwelling. On 3 December 2014 Government also announced that it will increase the annual amount of the ATED charge by 50% above inflation for residential properties worth more than GBP 2 million for the chargeable period 1 April 2015 to 31 March 2016. The current annual charges, taxable value bands, and proposed new charges are shown below.

See our next Real Estate Bulletin for “Part 2: New capital gains tax charges for sales of UK residential property by non-residents”.