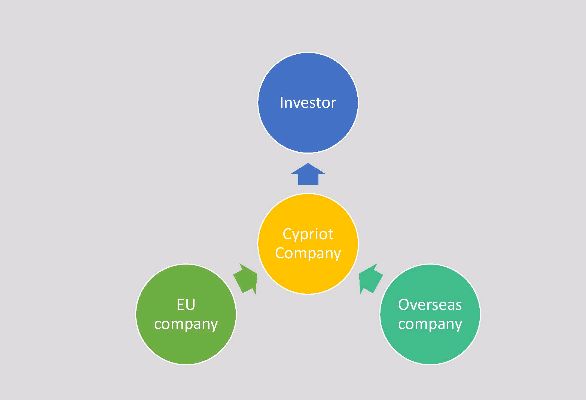

One of the reason for this situation is the ongoing support of government policy to establish Cyprus as one of the main financial hub in this global economy. A holding company is usually used to hold tangible or financial asset on behalf of investor or beneficial owners. There are many motives for an investor to establish an intermediate (the holding company) between him and the end asset and are as follow:

Confidentiality

In certain economic activities, investor would like to keep their ownership right private for any reason they would like

Tax motive

An offshore legal entity would be taxed in a different tax regime compared to individual investor.

Dividend

Dividend income received by a Cypriot would exploit the wide range of Double Taxation Treaties that Cyprus has with a number of countries Cyprus as a member of European Union can exploit the EU Parent- Subsidiary Directive which effectively eliminates dividends between a Cypriot holding company and an EU subsidiary

Interest and Royalty

In addition it may exploit the EU Interest and Royalty Directive and minimise any withholding tax on fund transfer between group or third parties transaction

Divestment – Asset sale

Crystallise gain arise from the disposal of a subsidiary would be excluded from any tax. On top of this there is no minimum ownership time-frame barrier

Extractions of profits

There are no withholding tax on dividends paid to foreigners by Cypriot company

Private equity

In many cases investor would like to minimise risks on single project by inviting other investor to participate on that economic activity by providing funding. In that case all parties would prefer to separate that specific group of assets into a separate legal entity for many reasons. The new investor would initially prefer to invest on the project by acquiring debt issued by the company which controls the end assets instead of directly acquiring a certain amount of equity on that company. A major issue of this situation would how much creditability the controlling company would have on the point of view of new investor. To increase credibility, existing owners must use regulated stock exchange to list the bond by having thirds parties confirming the legality of this economic transaction. In other words, an indirect due diligence process takes on behalf of the new investor.

Real estate investments

A Cypriot company can be used as an intermediate between the investor and receive rental income on his behalf. The main benefit of this structure is to avoid taxes on land registry in a given country since a share sale is much easier than a property sale.